is there a florida inheritance tax

This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption. If however you inherit property or assets in another.

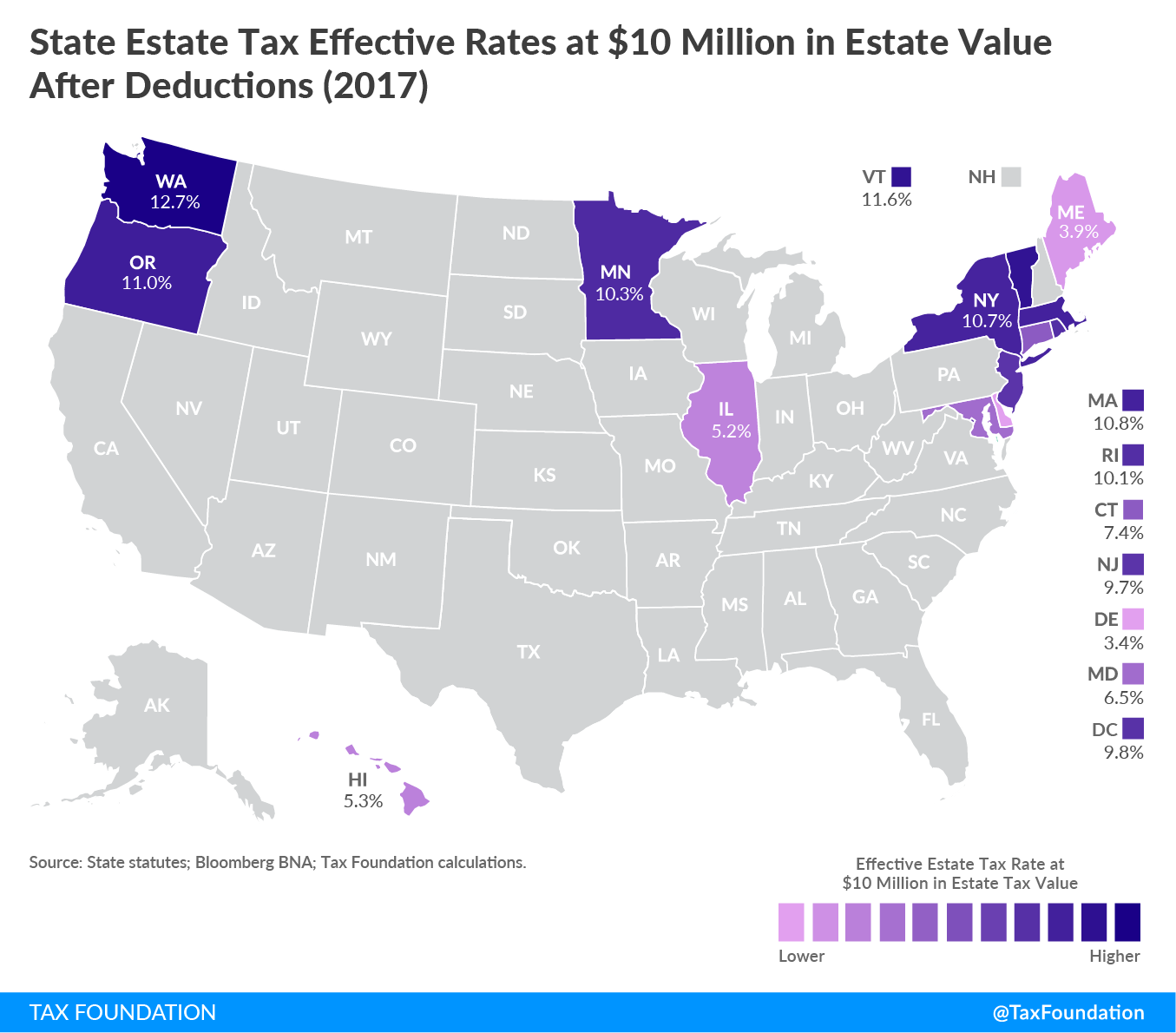

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Some people are not aware that.

. There is no federal inheritance tax but there is a federal estate tax. While many states have inheritance taxes Florida does not. Fortunately the inheritance tax rate in.

There is no inheritance tax or estate tax in Florida. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023. There are exemptions before the 40 rate kicks.

This means if your mom leaves you 400000 you get 400000 there are no. Inheritance Tax in Florida. The State of Florida does not have an inheritance tax or an estate tax.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit. Yet some estates may have to pay a federal estate tax.

For 2017 the Federal Estate and Gift Tax Rate is 40. Estates of Decedents who died on or after January 1 2005. Be sure to file the following.

Florida Inheritance Tax and Gift Tax. More and more people are being caught in the inheritance tax net - between April to September 2022 HMRC processed inheritance tax receipts of 35billion. Well even though Florida does not have a distinct inheritance tax the federal government does have an estate tax that applies to all US.

Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. Yes there are tax concerns for those who receive an inheritance in Florida in addition to the federal inheritance tax guidelines. Also known as estate tax or death tax the inheritance tax is the legal rate at which a state taxes the estate of someone who died owning property.

This tax is different from the inheritance tax which is levied on money after it has been passed on to the deceaseds heirs. If the estate is not required to file. The tax rate varies.

For the estate tax a Florida resident or for that matter. In most cases since there is no Florida estate tax you will never have to pay estate taxes in Florida and neither will your heirs. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete.

You wont have to pay estate taxes on an inheritance in Florida. Florida also does not have a separate state estate tax. An estate tax is a kind of tax that applies to the property left behind by a deceased person.

How much can you inherit tax free in Florida. Is inheritance taxed in Florida. The Federal government imposes an estate tax which begins at a whopping.

In 2020 there is an estate tax exemption of 1158 million meaning you. Beneficiaries need to be mindful of the following situations. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth.

No Florida estate tax is due for decedents who died on or after January 1 2005.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Florida Have An Estate Tax

![]()

Florida Inheritance Tax And Estate Tax Explained Alper Law

Does Florida Have An Inheritance Tax

Florida Estate Tax Everything You Need To Know Smartasset

Federal Estate And Missouri Inheritance Taxes Legacy Law Missouri

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Expatriation From The United States Part 2 The Inheritance Tax Florida Institute Of Cpas

Do Inheritance And Estate Taxes Apply In Florida

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Florida Estate Tax Everything You Need To Know Smartasset

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Estate Tax Planning In Florida Roth Iras Mastry Law Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Florida Have An Inheritance Tax

Desantis Delivers An Estate Tax Savings Gift For Floridians

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)